What Does Paul B Insurance Do?

Wiki Article

Paul B Insurance Can Be Fun For Anyone

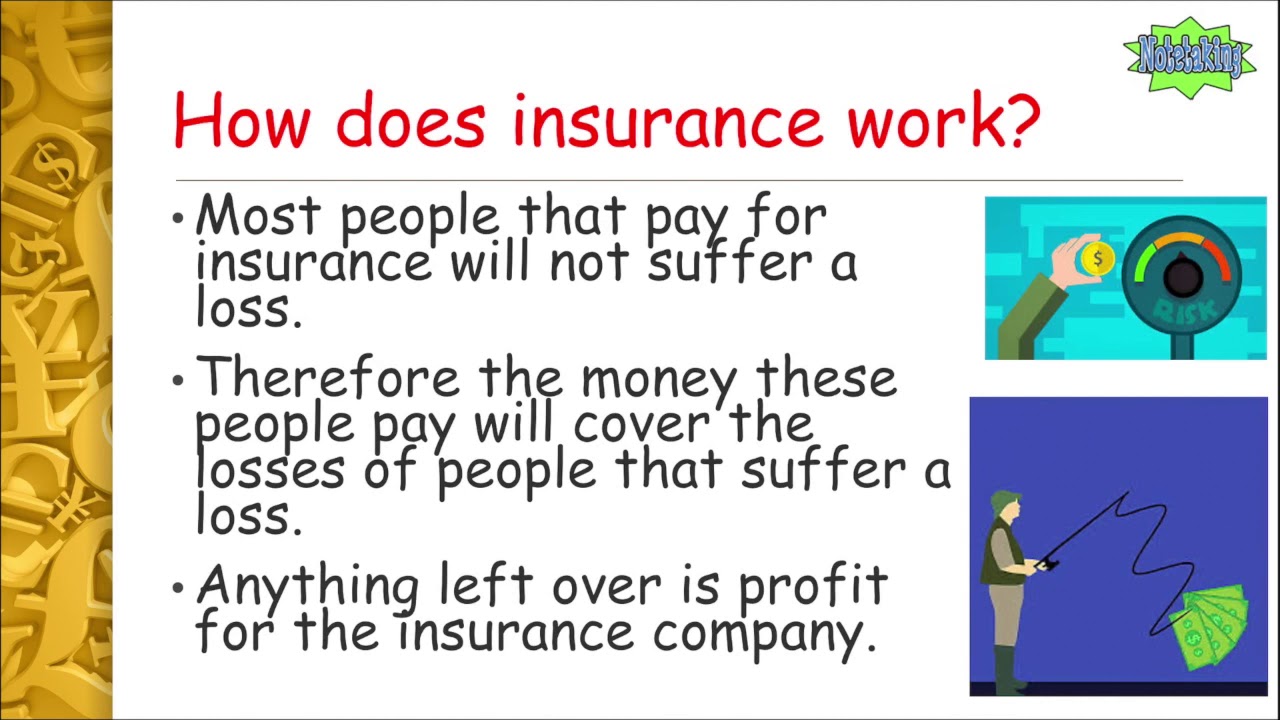

The idea is that the cash paid in insurance claims over time will be less than the total premiums gathered. You might really feel like you're throwing money out the home window if you never ever file a case, yet having piece of mind that you're covered on the occasion that you do suffer a considerable loss, can be worth its weight in gold.

Visualize you pay $500 a year to guarantee your $200,000 house. This implies you have actually paid $5,000 for residence insurance policy.

Due to the fact that insurance is based on spreading the danger amongst many individuals, it is the pooled money of all people paying for it that enables the firm to construct possessions as well as cover cases when they occur. Insurance is a company. It would certainly be wonderful for the business to simply leave prices at the very same level all the time, the fact is that they have to make adequate cash to cover all the prospective claims their policyholders might make.

The Ultimate Guide To Paul B Insurance

just how much they entered premiums, they must modify their prices to generate income. Underwriting modifications and price boosts or reductions are based upon outcomes the insurance coverage firm had in previous years. Depending on what company you buy it from, you might be managing a captive agent. They sell insurance policy from only one business.

The frontline individuals you manage when you acquire your insurance are the agents and also brokers who represent the insurer. They will certainly discuss the sort description of why not check here products they have. The captive representative is a representative of just one insurance business. They an acquainted with that firm's items or offerings, yet can not speak in the direction of various other business' plans, prices, or product offerings.

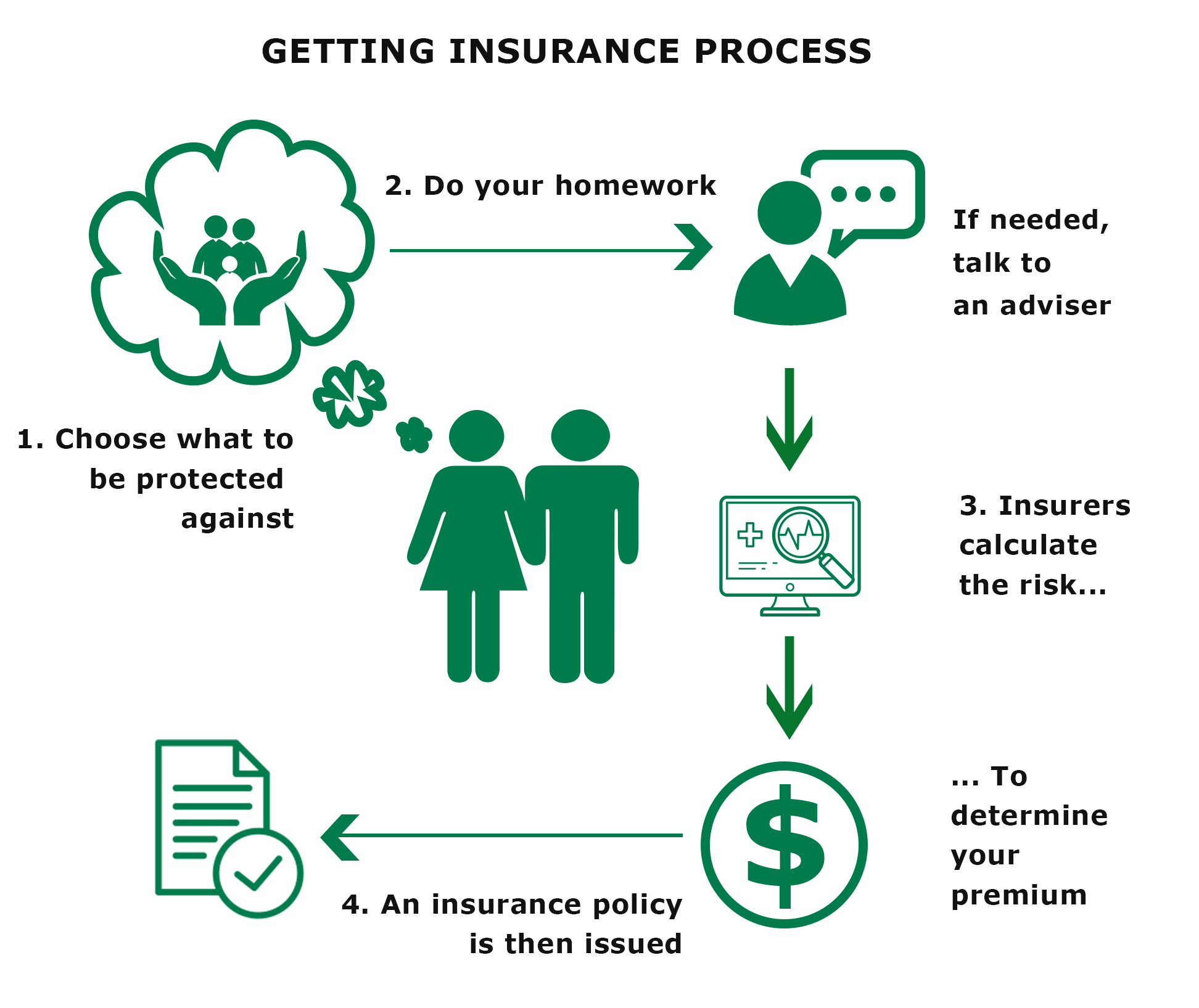

How much danger or loss of money can you assume on your very own? Do you have the cash to cover your expenses or debts if you have a mishap? Do you have special needs in your life that need extra insurance coverage?

How Paul B Insurance can Save You Time, Stress, and Money.

The insurance policy you require differs based on where you are at in your life, what kind of assets you have, and what your long term goals and duties are. That's why it is vital to take the time to review what you desire out of your plan with your representative.

If you get a car loan to purchase a cars and truck, and afterwards something occurs to the automobile, space insurance will repay any kind of part of your funding that standard auto insurance policy does not cover. Some lenders need their consumers to bring gap insurance coverage.

The main objective of life insurance policy is to give cash for your recipients when you die. Yet how you pass away can determine whether the insurance firm pays out the fatality benefit. Depending upon the sort of policy you have, life insurance coverage can cover: Natural deaths. Passing away from a cardiovascular disease, disease or seniority are instances of natural deaths.

Discover More

Indicators on Paul B Insurance You Need To Know

Life insurance policy covers the life of the guaranteed person. Term life insurance coverage covers you for a duration of time picked at purchase, such as 10, 20 or 30 years.

Term life is prominent since it uses big payouts at a lower expense than irreversible life. There are some variants of regular term life insurance policies.

Long-term life insurance policies construct cash money value as they age. The cash value of entire life insurance plans grows at a fixed price, while the money value within global plans can change.

The 6-Minute Rule for Paul B Insurance

$500,000 of whole life insurance coverage for a healthy 30-year-old woman costs around $4,015 each year, on standard. That very same degree of protection with a 20-year term life policy would certainly cost a standard of concerning $188 every year, according to Quotacy, a broker agent company.

Variable life is one more long-term life insurance choice. It's a different to whole life with a fixed payment.

Here are some life insurance policy basics to help you much better understand just how protection functions. Premiums are the payments you make to the insurance policy business. For term life plans, these cover the cost of your insurance and administrative expenses. With a long-term plan, you'll also be able to pay money right into a cash-value account.

Report this wiki page